Top CMBS servicers recommend Paragon

Average closing time for defeasance transactions

Completed defeasance transactions across all property types

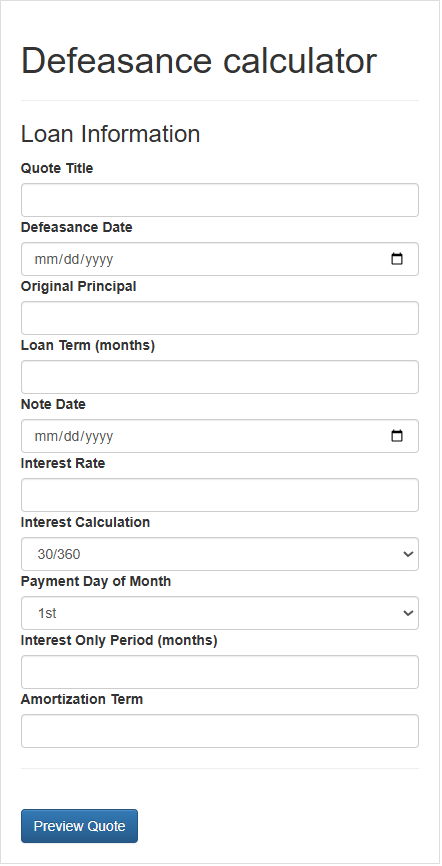

Gain immediate clarity on your loan exit costs with our estimation tools. While these provide preliminary figures, a full consultation will deliver a precise analysis tailored to your specific loan documents.

Estimate the cost of defeasing your loan, including the replacement collateral portfolio and standard third-party fees. Get a clear financial picture in seconds.

Estimate the cost of defeasing your loan, including the replacement collateral portfolio and standard third-party fees. Get a clear financial picture in seconds.

Insider Perspective

We know how servicers think. That insight turns complex requirements into simple steps so your team stays ready.

Insider Perspective

We know how servicers think. That insight turns complex requirements into simple steps so your team stays ready.

Proven Excellence

Trusted by two top-five CMBS servicers, we guide borrowers efficiently to avoid resets and delays.

Get clarity and control over your defeasance. Contact Paragon, the only independent consultant recommended by two of the nation’s top five CMBS servicers, to ensure your transaction closes on time and without surprises.